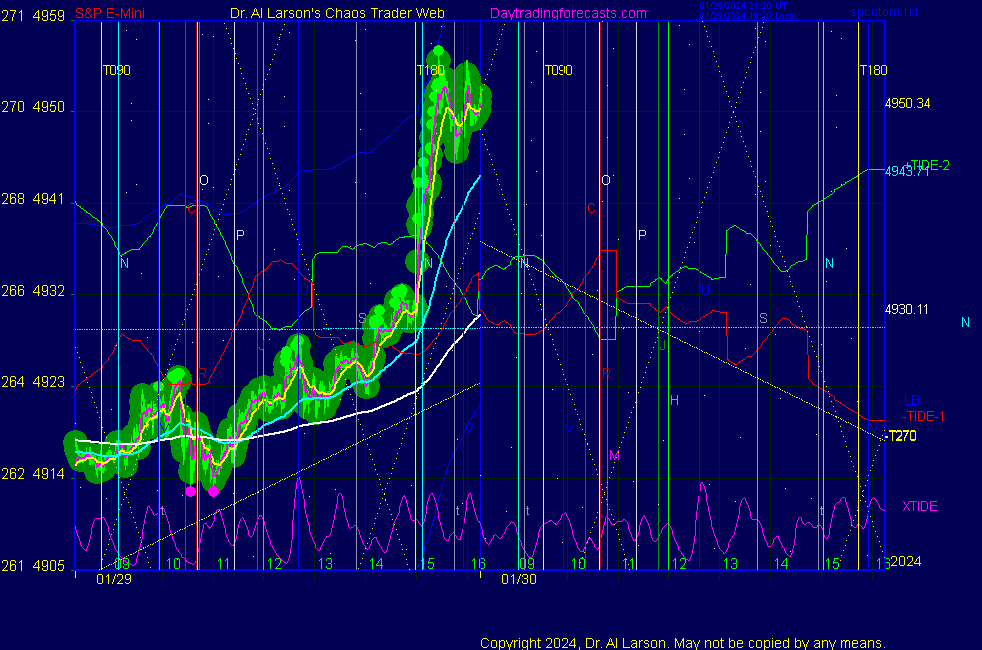

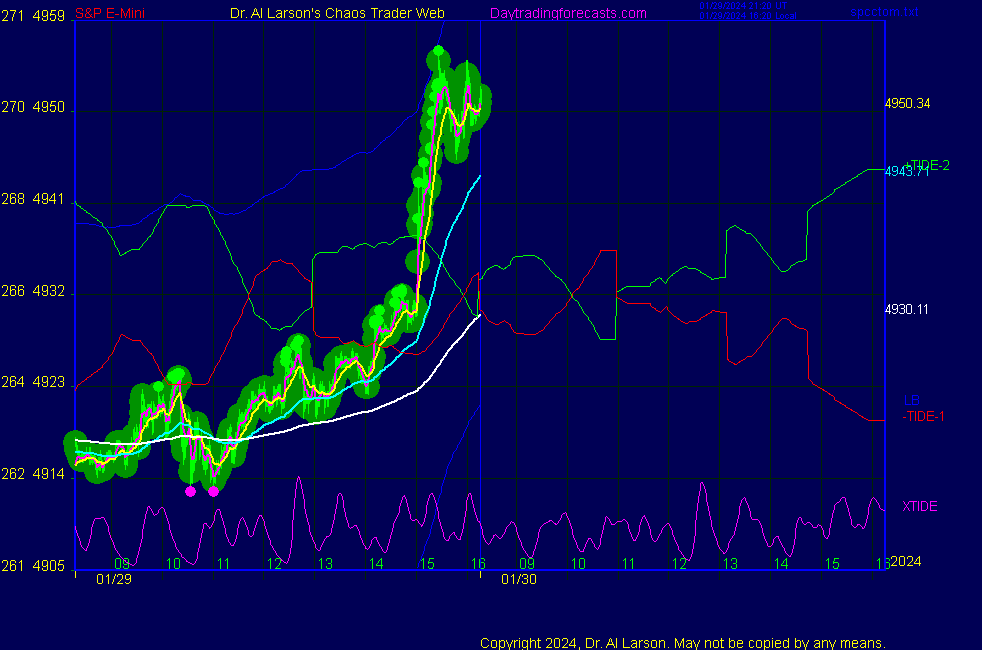

___________________________________________________________________ charges for this hotline show up on your statement under MicroMedia that's the name of my business, owner of daytradingforecasts.com ___________________________________________________________________ Don't be intimidated by all the complexity of the astro stuff. Our approach is simple. Watch a simple chart, like SP1Day or SPKISS- *- with 3 minute bars, 20 minute (6 or 7 bars) EXMA, and 110 minute (36 bar) EXMA. Look at the trade times in the Strategy section below. When within about 45 minutes of the trade times, follow the rules given in the Standing Instructions. Keep it simple. Be patient. It works over time. Read the Trading the MoonTides Tutorial and Keep It Simple on the List of Charts page. Also read Finer Timing of the MoonTides, and Trading The MoonTide Rainbow. Check the upcoming Economic reports daily. They are linked on the left side of the ListOfCharts page under Economic News all times given are Eastern Ninja Traders: if your are a paying customer, you will see a link on top right side of ListOfCharts page to download the MoonTide indicator ******************************************************************* This is a very Chaotic market where the normal stops and targets will not work. But the EXMAs still do. They are good guides for stops. Targets 3 to 5 times normal are advised. Also, the 3 minute , 1 or 2 day charts may not show you all you need to know, so keep an eye on longer term charts, at least an hourly covering 4 weeks. !!! ******************************************************************** Today: as per Chaos Clinic, +7,+13 Tomorrow: Moon square Neptune **************************************************************************** during these volatile times, the point values in these instructions should multiplied by 5 ***************************************************************************** For trade times before 11:00, be sure to use EXMA's that include data from 8:15 Eastern Normal Rules ( as published on daytrading forecasts.com in the tutorial): These fit a Trend or Trend continuation scenario, identified by prices trading within a couple of points of the 110 minute EXMA, taking profits on a 12 point range. 1. Watch for the opportunity to go with the trend or change in trend at the time(s) given. Be alert for the turn coming early or late. Be patient and use the tracking indicators. Plan to trade in the direction of the 110 EXMA coming out of that time frame. Prices should stay on one side of the 110 EXMA and it should be moving, or curl up or down from a flat position. Prices should be within about 2 points of the 110 EXMA. The 20 minute EXMA should have crossed the 110 EXMA, or moved toward it and then pulled away from it. When this setup is clear, enter in the direction of the 110 EXMA with a 3 point stop. *** in volatile markets this may need to be 6 points If each setup is not clear 60 minutes after the given time, skip the trade. 2. Move the stop 1 point each 30 minutes. If the market moves decently, trail it by 3 points ( 6 points in volatile markets). 3. Cover on a 5 point gain**, 90 minutes after entry , at the next Tide turn , or if the prices clearly recross the 110 minute EXMA. ********************************************************************** **FAST MOVE RULE If the trade gains 3 points within 30 minutes of entry, press the stop, using the 20 EXMA as a guide to move the stop to the low or high of each pullback (normally about 15 minutes long) once the move makes a new high or low. Cover any gain of 9* points. *It is OK to use the fast stop rule if a trade starts fast, but to then cover at +5 or +4 if it slows or stalls *** Stall rule: Cover any trade that stalls for more than 45 minutes *** Carry through rule If you are in a trade that is working well, if is OK to carry through the next Tide turn *** GO BIG rule: if morning is a big move (>12 points ), and midday is a congestion or pullback, and the last trade of the day sets up near 2:00, a move greater than 9 points may be captured using the technique illustrated at http://moneytide.com/hans/cc09092008.asp *** VOLATILE MARKET RULE -use with discretion in volatile markets, the 55 minute EXMA used in place of the 110 minute EXMA may provide an earlier and lower risk entry. This is most useful when the market is extremely oversold or overbought and reversing, or during a fast move with minimal dips and one is looking to join the move. |